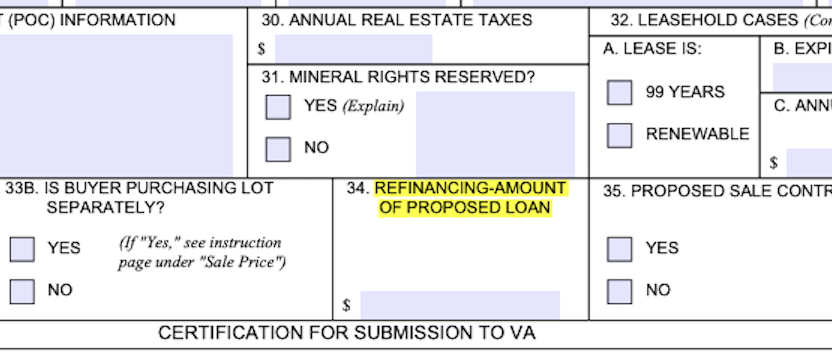

When a mortgage lender seeks to make a Veterans Administration-backed home loan, the lender requests an appraisal from the VA’s appraiser panel by using a form entitled Request for Determination of Reasonable Value. For many years, until it was revised in July 2022, this form had a box labelled “Refinancing-Amount of Proposed Loan.” This box asked the lender to fill in the proposed loan amount for refinances. Once submitted, the form begins the appraisal process and is provided to the appraiser assigned by the VA to perform the appraisal.

A lawsuit – Gregory v. Toler Appraisal Group and Gateway Mortgage Group – filed on behalf of a proposed class of borrowers in West Virginia alleges there’s problem here. The lead plaintiff contends that the mortgage lender’s provision of the proposed loan amount to an appraiser via use of this form violated federal Appraisal Independence Requirements (“AIR”) that are part of the Truth in Lending Act (in 15 U.S.C. § 1639e). These requirements make it unlawful for a creditor to seek “to influence an appraiser or otherwise to encourage a targeted value in order to facilitate the making or pricing of the transaction.” While the statute doesn’t explicitly mention that providing a loan amount is an AIR violation, the lawsuit complaint points to guidance in the Federal Interagency Appraisal and Evaluation Guidelines. That guidance states that inappropriate actions violating valuation independence include: “Communicating a predetermined, expected, or qualifying estimate of value, or a loan amount or target loan-to-value ratio to an appraiser or person performing an evaluation.”

Accordingly, in this case, the plaintiff borrower alleges that Gateway Mortgage violated federal Appraisal Independence Requirements when it included the proposed loan amount in the appraisal request for her loan back in 2018 and in the appraisal request forms for other VA borrowers. On behalf of other Gateway Mortgage borrowers in West Virginia, the action seeks, among other potential remedies:

- Restitution to borrowers of the appraisal fees;

- Statutory damages of up to $4,000 per borrower; and

- Other damages that may stem from the alleged AIR violations.

The case also includes an individual claim by the plaintiff that the appraisal for her loan was inflated – and she is suing the appraisal firm for alleged professional negligence on that basis. A central problem alleged with the appraisal is that the home described in the appraisal is not located on the real property appraised.

While this case is currently pending in U.S. District Court for the Southern District of West Virginia, it was first filed in April 2020. Why am I writing about it now? Because the District Court has just ruled on an important issue.

Gateway Mortgage sought to have the AIR violation claims dismissed, asserting in a motion for judgment on the pleadings that AIR violations could not be pursued by private plaintiffs. In legal jargon, Gateway Mortgage contended that 15 U.S.C. §1639e does not create a “private right of action.” On May 17, 2023, however, the Court ruled against Gateway Mortgage on that fundamental point. As the Court wrote: “Looking at the language of the statute, the Court finds no ambiguity – Congress intended to create a private right of action for violations of §1639e.“

The Court’s unambiguous ruling shines a light on an opening for other claims by borrowers alleging AIR violations.

Links to the complaint in the action and the Court’s ruling are below.

Thank you, Peter Christensen