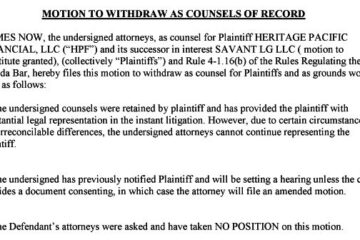

This is an update on the new mass litigation phenomenon against appraisers. Llano Financing Group LLC continues to be the front runner in filing lawsuits against appraisers. In all of the recent lawsuit complaints I have reviewed from June-August 2015, Llano Financing is suing appraisers over claims that were purportedly first assigned by Impac Funding, a subsidiary of Impac Mortgage Holdings, to Savant LG and then re-assigned to Llano for litigation. Accordingly, the roots for this massive litigation against appraisers come from loans that Impac originated, purchased or serviced (mostly from 2004-2007) and Impac’s recent sale/assignment of rights to sue appraisers over the loans that went into foreclosure.

-

- Llano, through mortgage and debt collection law firms, has continued to file dozens of new lawsuits concerning appraisals for Impac’s loans.

-

- The heaviest concentrations of new lawsuits are in Illinois, where Llano has filed more than 25 lawsuits in August (the screen image shows some of the recent cases filed in just Cook County), with a smaller numbers of new lawsuits in Arizona and Nevada.

-

- In connection with Impac’s loans, Llano has now filed over 225 lawsuits, naming more than 350 appraisers and appraisal firms as defendants. “Standing in the shoes” of Impact Funding, Llano has sued appraisers residing in Arizona, California, Colorado, Florida, Illinois, Indiana, Iowa, Nevada, New Hampshire and New Jersey.

-

- Aside from lawsuits, Llano also has turned to sending demand letters to appraisers, threatening to sue them or file disciplinary complaints to their state boards unless the appraisers pay money to Llano. So far, no appraisers have reported the actual filing of any disciplinary complaints by Llano or Impac — and most state boards would be loathe to consider complaints about 10+ year old appraisals filed by a party like Llano and likely would be more interested in disciplining any appraisers creating the non-complaint review appraisals Llano has procured to support its claims.

-

- In the first “test round” of nine cases that Llano filed in federal court in Florida and New Jersey in December 2014, Llano already has lost seven of those cases and the appraisers have been dismissed. In the new round of cases, it has tried to adjust its strategy by filing most of its recent cases in state courts using different lawyers and pushing slightly different, often inconsistent, legal contentions.

-

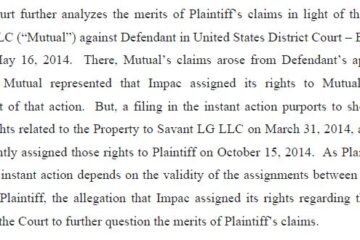

- If Llano’s new cases go forward, Impac’s own lending and appraisal practices

will very much be “on trial” along with the appraisers. The reasons for this are threefold: Llano,

as Impac’s assignee, is now “standing in the shoes” of Impac and all of the defenses that would have applied to claims by Impac itself will made by the appraisers (an example assignment is shown to the right); Impac’s own mortgage and underwriting files, including its appraisal review, quality control and documentation, will be highly relevant information in each case; and Llano is claiming in the lawsuits, among other things, that Impac would not have funded or purchased the loans at issue in each case if the valuations had been “correct.” Attorneys representing defendant appraisers in these cases will soon be seeking documents and deposition testimony from Impac and its past and present personnel.

- If Llano’s new cases go forward, Impac’s own lending and appraisal practices

-

- Because of Impac’s willingness to sell/assign the rights to sue appraisers to an entity like Savant LG and the widespread litigation that has followed, appraisers are asking whether they should perform current appraisal work for Impac and its related lenders, such as CashCall, or for clients who sell or fund loans with them. Impac is the only lender/mortgage investor engaging in this practice on a widespread basis at this time.

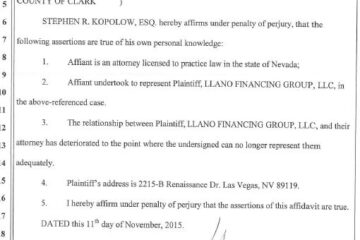

- In prior posts, I have written about First Mutual Group and Mutual First, who both attempted to do the same thing that Llano is having a run at now. The source of this litigation scheme for all of the various parties is the same: Savant LG, aka Savant Claims Management, and its principals. As of this date, the outward appearances are that First Mutual Group (and the alleged English investors behind it — Alternative Capital Strategies) and Mutual First have given up. In 2014, they filed more than 100 lawsuits against appraisers in federal courts in Texas, Florida and New Jersey. So far, at least 89 of those lawsuits have been dismissed against them, and I have seen no case among the 100+ in federal court in which either First Mutual Group or Mutual First recovered any damages from any defendant appraiser. (If any readers know of any case in which they recovered money from an appraiser, please let me know.) And, most recently, in newer state court cases, Llano Financing is now suing appraisers that First Mutual Group previously contended it owned the right to sue, while lawyers representing First Mutual Group in cases in California have asked the courts for permission to withdraw from working for First Mutual Group, citing payment issues.

Please check back for more updates in the near future.