The FDIC continues to sue residential appraisers in connection with origination appraisals and review appraisals performed for failed lenders between 2003-2009 on loans now in default. It may be helpful, or scary, for appraisers and AMCs to see for themselves exactly what kinds of alleged USPAP violations or other errors the FDIC is claiming in lawsuits against appraisers. Therefore, I have copied below the FDIC’s actual allegations against several appraisers. These are word-for-word the entirety of the FDIC’s claimed errors against these appraiser defendants. Please don’t shoot the messenger. I’m a lawyer, not a USPAP expert, but even I know some of these things aren’t really “USPAP violations” despite the FDIC’s allegations.

The FDIC’s favorite alleged “USPAP violations” or other alleged errors in its most recent cases have been:

- “USPAP required that [the appraiser] analyze whether the level of appreciation was sustainable;”

- The comparable is “more than one mile from the subject property;” and

- The comparable “involved a sale that was more than six months old.”

Even though the complaints filed by the FDIC in court are all public documents, I’ve chosen to conceal the appraisers’ names because I don’t think the focus should be on who they are — they could be any of tens of thousands of appraisers who delivered appraisals to failed lenders now under FDIC receivership.

Again, the portions of the FDIC’s complaints I’ve provided below are word-for-word the entirety of the FDIC’s claimed errors in the lawsuit complaints against these appraiser defendants. In other words, I’m not cherry-picking from the FDIC’s allegations or taking them out of context. (In fact, if we looked at the full context of the loan transactions in these lawsuits, the complete stories involve borrower and mortgage broker misrepresentations about occupancy, employment and income.)

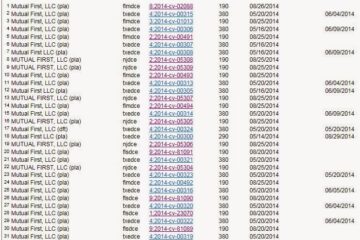

1. FDIC v. Appraiser (in Black):

In this 2011 case, the FDIC sued the appraiser for alleged professional negligence relating to appraisals for two loans extended in 2005. The FDIC demanded $518,000 in damages against the appraiser. Below are the FDIC’s allegations about the alleged errors in one of the appraisals:

2. FDIC v. Appraiser (in Black) and Review Appraiser (in Red):

In this 2011 case, the FDIC sued the appraiser for alleged professional negligence relating to an appraisal for a loan extended in 2005. The FDIC alleged damages of $554,821 against the appraiser. The FDIC also sued a review appraiser in connection with a review of the first appraiser’s report and for failing to identify the alleged issues in the original report. Below are the FDIC’s allegations about the alleged errors in the appraisal and review:

3. FDIC v. Appraiser (in Black) and Review Appraiser (in Red):

In this 2011 case, the FDIC sued the appraiser for alleged professional negligence relating to an appraisal for a loan extended in 2005. The FDIC also sued an appraiser who performed a field review agreeing with the value stated in the first report. The FDIC sought damages of $301,398 against both appraisers. Below are the FDIC’s allegations about the alleged errors in the appraisal and review:

4. FDIC v. Appraiser (in Black):

In this 2011 case, the FDIC sued the appraiser for alleged professional negligence relating to an appraisal for a loan extended in 2005. The FDIC alleged damages of $310,839 against the appraiser. Below are the FDIC’s allegations about the alleged errors in the appraisal:

5. FDIC v. Appraiser (in Black) and Review Appraiser (in Red):

In this 2011 case, the FDIC sued the appraiser for alleged professional negligence relating to an appraisal for a loan extended in 2006. The FDIC alleged damages of $283,521 against the appraiser. The FDIC also sued a review appraiser because “she failed to note or comment upon any of the USPAP violations.” Below are the FDIC’s allegations about the alleged errors in the appraisal and review:

[sic (the FDIC’s complaint appears to be missing some words here.)]

6. FDIC v. Appraiser (in Black):

In this 2011 case, the FDIC sued the appraiser for alleged professional negligence relating to an appraisal for a loan extended in 2005. The FDIC alleged damages of $103,165 against the appraiser. Below are the FDIC’s allegations about the alleged errors in the appraisal:

More example allegations from the FDIC’s lawsuits are available to LIA insured appraisers and other members of READI on http://www.readimember.org/

Peter Christensen is an attorney who advises professionals and businesses about legal and regulatory issues concerning valuation and insurance. He serves as general counsel to LIA Administrators & Insurance Services. He can be reached at [email protected].