The FDIC’s complaint in this case is virtually identical to the dozens of other MBS complaints against mortgage originators and aggregators filed by pension funds, insurance companies, banks and other MBS investors. The newsworthy point here is that the FDIC is deciding to join in this litigation boondoggle and is doing it exactly in the same way as many “civilian” MBS investor plaintiffs. For the appraisal industry, it’s also worth observing that the FDIC is using the same retrospective AVM model as the other MBS plaintiffs to claim the appraisals at issue were flawed and failed to comply with USPAP.

All of these MBS lawsuits involve allegations that the mortgage originators and aggregators made false statements or omitted material facts in the offering documents for the MBS. The misrepresentations and omissions often relate to appraisal issues, and MBS complaints almost uniformly allege that the appraisals of properties securing mortgages in the MBS inflated property values, resulting in misrepresented loan-to-value ratios and higher default risks. As written previously about on this site, the appraisal industry itself has almost escaped entirely from being dragged in as defendants to any of this multi-billion dollar MBS litigation (with a notable AMC exception). However, what emerges from the allegations in the lawsuits is ugly enough for the appraisal industry, especially now that the FDIC is making exactly the same allegations in its own MBS complaints.

The lawsuit that the FDIC filed as receiver for Security Savings Bank is small potatoes as far as MBS litigation. It concerns only a $1.8 million investment made by the failed bank in one offering. The story told by the FDIC, however, is the same as in bigger cases. Like other MBS complaints from the law firm Grais & Ellsworth, the FDIC’s allegations about appraisal inflation are based on the use of a “retrospective AVM.” This is the praise that the FDIC offers about that AVM in its complaint; it sounds more like a commercial endorsement from the FDIC for the AVM, than a legal allegation:

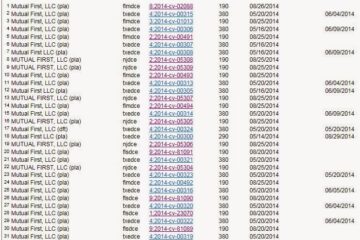

The FDIC alleges that it ran this AVM retrospectively on 2,064 properties securing loans in the MBS and that the AVM showed that the appraisals for those loans overstated “the true market value as determined by the model” by 105% or more for 707 of the properties. Here is a summary chart from the FDIC’s complaint:

Based on its use of the AVM model, the FDIC concludes that “there was undisclosed upward bias in appraisals of properties that secured mortgage loans” and that the “defendants’ statements regarding the LTVs of the mortgage loans in the collateral pool were misleading.” The FDIC further concludes that “the defendants stated the appraisals conformed to the Uniform Standards of Professional Appraisal Practice (USPAP) . . . [and] those statements were false because upwardly biased appraisals do not conform to USPAP.” All of these allegations are based on the results delivered by the retrospective AVM; at this point, the FDIC may not even have reviewed the appraisals themselves.

Again, the allegations in this complaint are nothing new — identical allegations are being made in dozens of other MBS cases. What is new here is that it is the FDIC alleging these things.