In 2011, the Federal Deposit Insurance Corporation (FDIC) has continued to file a high number of lawsuits against real estate appraisers blaming them for loan losses of the failed lenders that the FDIC and other agencies supervised during the mortgage bubble years 2004-2008. Most of the FDIC’s recent lawsuits concern loans made or purchased by Indymac – that’s probably because the 3-year statute of limitations extension period that the FDIC receives under federal law in which to file negligence claims expired on July 10, 2011 as to Indymac. So, the FDIC’s attorneys rushed to courthouses to file their cases before the end of that period. This is not to say that appraisers or other targets of FDIC claims about Indymac loans now have “get out of jail free cards.” For one thing, the extension period for contract claims by the FDIC is 6 years and the FDIC frequently seeks to assert contract claims against professionals. Also, the FDIC will certainly argue in any future particular Indymac cases that the applicable statutes of limitation have not run based on the facts and circumstances of each case. (One of the lawsuits the FDIC’s attorneys rushed to file was a $600 million complaint against Indymac’s former CEO Michael Perry. That complaint filed on July 6 is available here.)

With respect to appraisers, the FDIC only sues about one thing – that the defendant appraiser

allegedly overvalued a property securing a loan which later went into default and caused a loss. While the FDIC has sued or threatened to sue hundreds of appraisers, the FDIC has almost never filed any form of disciplinary complaint against appraisers for any alleged USPAP violations. The reason is that the FDIC’s only purpose in its professional liability actions is to try to recover money from a defendant – if there’s no money to recover, the FDIC has no interest in pursuing any action. But when there is money at stake, the FDIC is a very aggressive litigant. Many insurers are responding to the FDIC’s tactics by implementing exclusions for claims by the FDIC or limiting policies to providing defense against FDIC claims only – as opposed to paying damages. These new exclusions are being adopted in not only appraiser policies but also policies for mortgage professionals, real estate brokers and even attorneys. Such professionals simply do not – and cannot – pay enough premium to cover the FDIC’s philosophy that these professionals are financial guarantors of the loan losses suffered by the FDIC’s failed lenders.

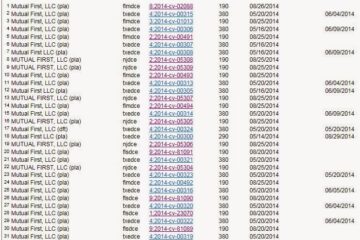

For appraisers, the most recent bad news about FDIC lawsuits is that the FDIC has sued 40 individual appraisers and appraisal firms since May 1, 2011 – not counting its two lawsuits against CoreLogic (eAppraiseIT) and Lender Processing Services, Inc. (LSI Appraisal) filed on May 9, 2011. The chart below shows where the unfortunate defendant appraisers and firms are located, when and where the cases were filed, and the identity of the failed lenders. As mentioned above, the bulk of the FDIC’s recent claims concern Indymac loans.